So close but yet so far!

So close but yet so far!

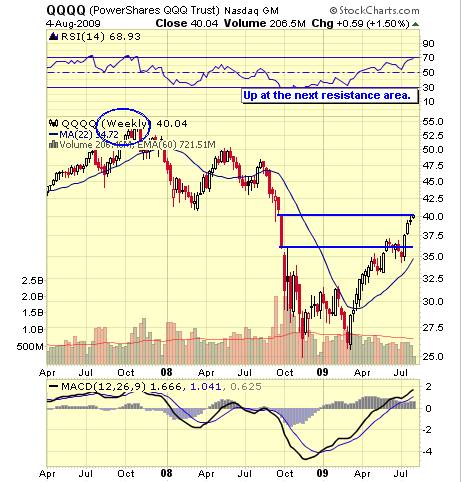

As you can see from David Fry’s chart of the QQQQ’s, the Nasdaq is looking to boldly go where no index has gone since last October, back through the September highs! If you lookat the chart pattern, we have a nice”W” bottom already in and a breakout here at 40 on the Qs could mean we’re heading back to where thedrop began – way up at47.5. That’s a neat 20% gain from here and that would give us Dow 11,160, S&P 1,200,Nas 2,400, NYSE 7,800 andRussell 700.

What? Do you think that sounds like a bit much? Well, ifyou question the resulting trend of a breakout then perhaps you shouldget ahead of the curve and question the breakout in the first place…

Does it strike you as strange that a breakout here and amove up to the top of that “W” would put stocks back to where they were valued last June, when the average company earned twice as much on 35% more revenues? Do you really consider MRO a value because they beat expectations of .53 by earning .58, “just” 39% below last Q2. MGM is down 21%, TAP down 54%, RRI down 61%, APC down 37%, CTX down 49%, FST – 64%, LF -27%, PHM – 57%, VMC -29%, ADM – 24%…. Well you can look them up yourself here and I’m not saying there aren’t winners in this market, but they are few and far between yet the rally is indiscriminate – as if the whole market is spectacularly undervalued.

While I have long been in the camp of those saying “The economy is not that bad,” I do have to, at this juncture, point out that the economy is notTHAT good either. Keep this in mind when you are buying stocks. How far away are we from your company earning what it earned last year? What is your expected growth rate. Keep in mind that last June, your company had positive guidance and was projecting revenues and earnings 10-20% higher than that by 2010 and all we are saying here is how long will it take your company to get back to what it was earning in 2008? If you say 2 years – then look at the price of your stock in 2006 – THAT is probably a fair value for your stock!

While I have long been in the camp of those saying “The economy is not that bad,” I do have to, at this juncture, point out that the economy is notTHAT good either. Keep this in mind when you are buying stocks. How far away are we from your company earning what it earned last year? What is your expected growth rate. Keep in mind that last June, your company had positive guidance and was projecting revenues and earnings 10-20% higher than that by 2010 and all we are saying here is how long will it take your company to get back to what it was earning in 2008? If you say 2 years – then look at the price of your stock in 2006 – THAT is probably a fair value for your stock!

XOM, for example, made $8.47 per share last year but made just $1…