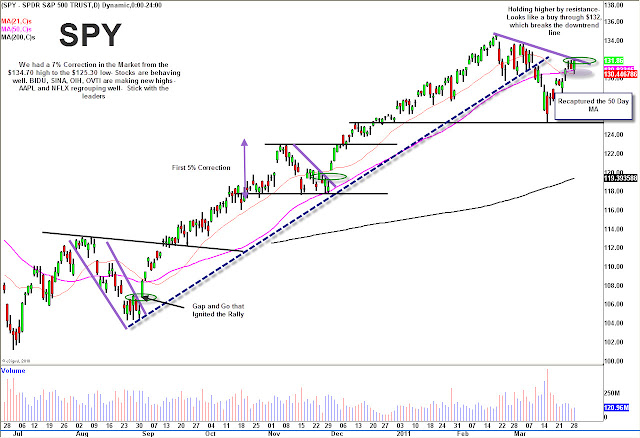

US stock futures point to a healthy up open on Wall Street after yesterday’s reversal off the 50-day moving average. Yesterday the market was weak early but the reclaimed MA acted as support and we rallied hard right into the upper end of the three-day range. Overnight Investor’s Business Daily put us in a “Confirmed Rally”, which is usually a positive sign, but also a signal that the market could use a little bit of rest.

At this point, we have gotten big move off the lows and new market leaders have emerged based on relative strength during the pull-back. When a correction takes place, it’s important to see what stocks hold above moving averages, as those are usually the first ones to bounce. Now it will be interesting to see some of the weaker groups can also perk up and participate in this move back to the highs.

For more market and stock commentary, watch the T3Live.com Morning Call below, with Scott Redler and Alix Steel.

Tech Leads the Charge

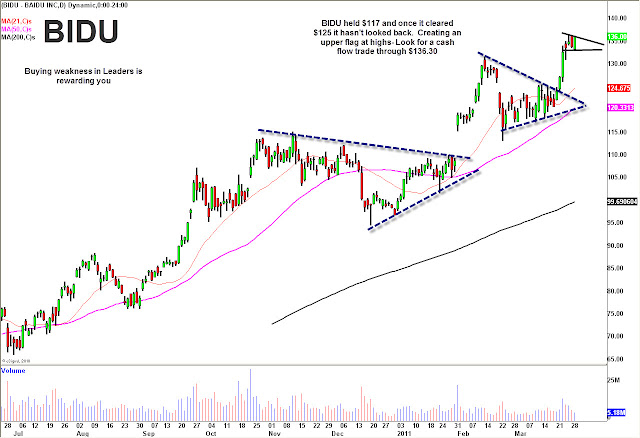

Tech has been the most exciting group during this bounce with many stocks highlighted in the T3Live.com Morning Call making big moves. Chinese stocks Baidu.com, Inc. (BIDU), SINA Corporation (SINA) and Sohu.com, Inc. (SOHU) have all made big moves since being listed as solid buys last week. Priceline.com Incorporated (PCLN) also continues to stretch its legs at new highs after a big upgrade last week, while internet media company Travelzoo Inc. (TZOO) has perhaps been the strongest stock in the market, gaining 78% in just over a month.

After pulling in hard from highs, Netflix, Inc. (NFLX) has bounced with equal ferocity despite several suggestions of possible competition. The technical buy area for Amazon.com, Inc. (AMZN) was out of downtrend last week, but you also could have entered yesterday on a break above pivot highs yesterday. After being in the doghouse during most of 2011, Amazon looks like set to climb once again. A stock Scott Redler highlighted yesterday on the T3Live.com Blog was OmniVision Technologies, Inc. (OVTI), which is a hot semiconductor stock. It broke out of a recent cup and handle yesterday, gaining more than 8%.

Oil Servicers Making a Move

In the Morning Call Monday, the top play was the Oil Service HOLDRs ETF (OIH), which had consolidated for a week in a tight range after bouncing off the $150 level. The ETF broke out of that range Monday, posting solid gains, and tacked on another 2.3% yesterday. We fully expect this fund to continue higher to make new highs after closing right on them yesterday. Component Halliburton Company (HAL) has a similar chart to the OIH, but the fund’s biggest holding, Schlumberger Limited (SLB), was a monster yesterday, gaining 4.4%. Valero Energy Corporation (VLO) was another stock we highlighted with a great looking chart. It performed well yesterday and should break out to new highs.

Exxon Mobil Corporation (XOM) also looks good through the $84 as a potential buy as it is holding its 50-day moving average.

Under Armour Follows Lululemon

During this six-month market rally, we have seen two new-age apparel stocks continually post stellar quarters and tremendous gains: Lululemon Athletica inc. (LULU) and Under Armour, Inc. (UA). Monday we highlighted Lululemon as a possible long out of a nearly month base, and the stock has seen a monster two-day move of 12%. Yesterday, as a sort of “me too” play, Redler pointed to its cousin Under Armour as a stock that could get a boost. UA tacked on nearly 5% breaking out of a lower level consolidation.

Will Lagging Sectors Play Catch Up?

As mentioned previously, the real strength of a rally in its latter stages can be measured in whether some of the lagging sectors can also participate. Four such lagging groups are the casinos, banks, opticals and credit cards. Since a weak report from Las Vegas Sands Corp. (LVS), the company and the sector have been weak. Look to play leaders in the lagging sectors, which in this case is Wynn Resorts, Limited (WYNN), which looks good above the $128-129 pivot area for a move to new highs.

As far as the banks go, JP Morgan Chase & Co. (JPM) recently has been the leader, and looks good as a potential long through $46. Former leader Goldman Sachs Group Inc. (GS) is also worth a look after a RedDog reversal yesterday down and back up through the $156.41 level. GS can continue to the upside and at least see $163 in the short term.

The credit cards got smacked down when new proposed regulation was unveiled that would significantly eat into profit margins, but they have bounced back as there is some uncertainty regarding the timing and nature of the legislation. Yesterday on the Morning Call we highlighted the credit cards, and today we are seeing moves. Visa Inc. (V) and MasterCard Incorporated (MA) are set to open sharply higher on news that Durbin Rules could be relaxed.

Magnet Reveals Two Oversold Bounce Candidates

While many traders and investors feel they missed their chance to buy the dip, again, there are always stocks still setting up to move. Don’t chase something near the top of its trading range. Jordan Kimmel uses his Magnet Stock Selection Process to find stocks with accelerating earnings, revenues, and margins, and then incorporates technical timing tools to find stocks with great upside potential.

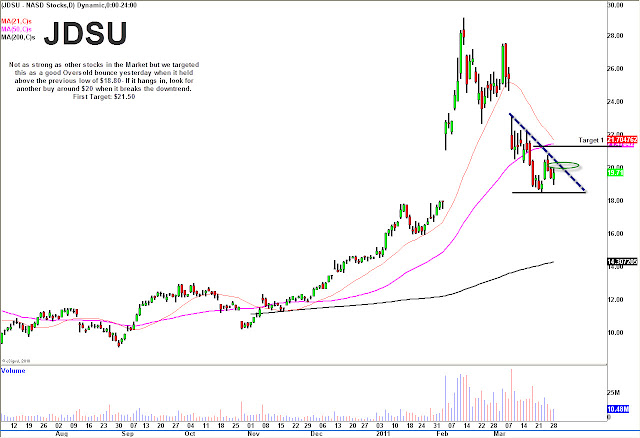

Two such highly ranked plays are JDSU Uniphase Corporation (JDSU) and Crocs, Inc. (CROX). JDSU in the optical networking group broke a big base, went to the top of the envelop and now looks ready to go again. CROX needed to consolidate, and has. Summer is coming (I think…) and international sales are playing a bigger role. The company also has new models that could boost sales.

*DISCLOSURE: Scott Redler is long AAPL, JDSU, AMZN, SOHU, LVS, GLD, JPM, V, BA, OIH, LEI, VLO, POT, NYX, DANG, OVTI; Short SPY.

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.