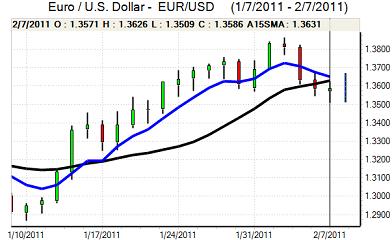

EUR/USD

The Euro was blocked in the 1.3620 area against the dollar during Monday and weakened steadily during the European session. There was a weaker than expected figure for German industrial orders which had some negative impact on the currency, although the Euro-zone Sentix business confidence index was stronger than expected.

Yield considerations also remained very important with the US currency still deriving some support from a narrowing of the two-year yield gap between US Treasuries and German bunds. There was a solid reading for US consumer credit which reinforced the mood of greater optimism towards the US economy with bond yields rising to the highest level since the second quarter of 2010.

ECB member Mersch stated that the central bank would take action if the inflation rise was not temporary, reinforcing expectations that the bank will take a wait and see attitude in the short term. Interest-rate trends elsewhere in Europe will also be watched closely and any move by the Bank of England to raise interest rates this week would renew expectations that the ECB will move to a tighter policy and this would provide some degree of Euro support.

There were still some fears over the Euro-zone structural outlook as Portuguese 10-year yields were above the pivotal 7% level. The Euro tested technical support below 1.3520, but found good support in this region with reports of fresh Asian sovereign buying and the Euro recovered to the 1.3625 area in early Europe on Tuesday. The dollar was still hampered by expectations that the Fed would continue to run a loose monetary policy.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to break above 82.50 against the yen during Monday and retreated back to the 82.20 area in US trading on Monday and again in Asia on Tuesday.

The US currency was still supported by an improvement in yields, but it was unable to break resistance levels despite increased buying. It is also the case that the dollar was significantly stronger than current levels when the yield gap was last at these levels, reinforcing the perception that interest rate factors may be playing a reduced role.

There was further evidence of exporter selling and there was also evidence of capital repatriation by Japanese companies. There will be scope for some seasonal yen support, but there will still be a lack of confidence in the Japanese fundamentals which will limit yen buying.

Sterling

Sterling pushed higher in European trading on Monday with a peak close to 1.6180 against the US dollar with further speculation over a potential interest rate increase by the Bank of England with 3-month Libor rates rising to an 18-month high.

The UK currency failed to hold the gains and weakened to test support below 1.61 during the US session. Sterling also failed to sustain a move beyond 0.84 against the Euro.

As far as the economic data is concerned, there was a modest improvement in the RICS house-price index to -31% for January from -39% while the BRC retail sales report recorded 2.3% annual sales growth.

Interest rate trends will dominate in the short term and markets have priced in a Bank of England rate increase by May. Sterling will continue to gain immediate support from speculation over a possible MPC tightening move this week, although it will then be vulnerable to a sharp reversal if there is no action by the bank. As the dollar failed to sustain its advance, Sterling rallied back to the 1.6150 area.

Swiss franc

The dollar hit resistance close to 0.96 against the franc on Monday and retreated to the 0.9540 area where there was solid support. The Euro found support above 1.2920 against the Swiss currency and rallied to re-test levels above 1.30.

Tensions surrounding the Euro area have eased with markets prepared to give the EU members the benefit of the doubt for now, but stresses could still emerge rapidly given the underlying structural issues. Seasonally-adjusted Swiss unemployment held steady at 3.5%.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

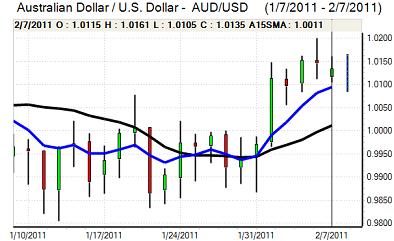

Australian dollar

The Australian dollar found support on dips to the 1.0110 area against the US currency during Monday and rallied to test resistance near 1.0160. Equity markets were firm which provided underlying support to risk appetite and the Australian currency.

There was also optimism surrounding this week’s employment data, although there is still a high risk that net confidence towards the domestic economy will deteriorate over the next few weeks. There will also be a further threat of Asian monetary tightening which would unsettle the Australian dollar.