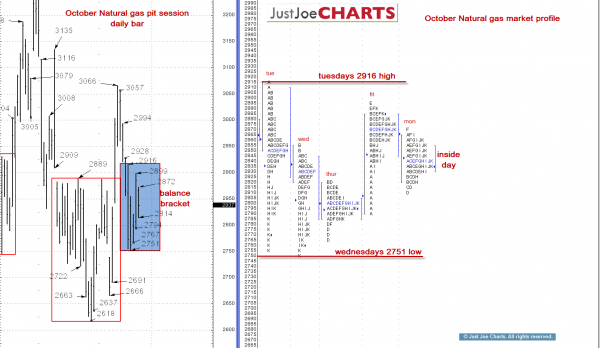

October natural gas futures have been contained within a 2.751 to 2.916 tight range for the last five days. The last four trading ranges were pretty much contained within last Tuesdays (9/18/12) range.

Additionally, Monday’s range was within Friday’s range, making it an “Inside Day.” An inside day is another form of balance. Additionally, an inside day within a tight five day balance bracket is considered “balance within balance.”

[Click here to read a story to learn more about Market Profile analysis. ]

BE READY FOR A BREAKOUT

When a volatile market such as Natural gas is contained within such a tight balance for an extended period of time, a significant move usually follows the breakout from balance.

FIRST STEP

The first step is to see which way the market breaks from the inside day. If the market breaks from Mondays inside day to the upside, the likely scenario is that it tests the 2.916 five day balance high. If the market breaks from the inside day to the downside, the likely scenario is that it tests the 2.751 five day balance low

SECOND STEP

One possibility is that the market may remain within this five day balance range for the near future. However, we need to be prepared for the break from the balance. If the market gains acceptance above the 2.916 five day balance, the 2.994 and 3.066 are important upside references.

If the market gains acceptance below the 2.751 five day balance low, 2.691 and 2.618 are important downside references.

Looking for more trading ideas? Read our daily Markets section here.