I hope everyone had an incredible and most enjoyable Thanksgiving holiday season. I went back to my “roots” in Georgia, spent time with the family and ate a copious amount of food– which included deer meat, turkey and gator tail. Gator is quite a chewy meat. I’ll let your imagination run wild regarding how I came into possession of such meats.

The reason for the story, I purchased my flight to Georgia with my Mastercard (MA). Which got me thinking, (dangerous I know) how is Mastercard doing as a company?

STOCK ACTION

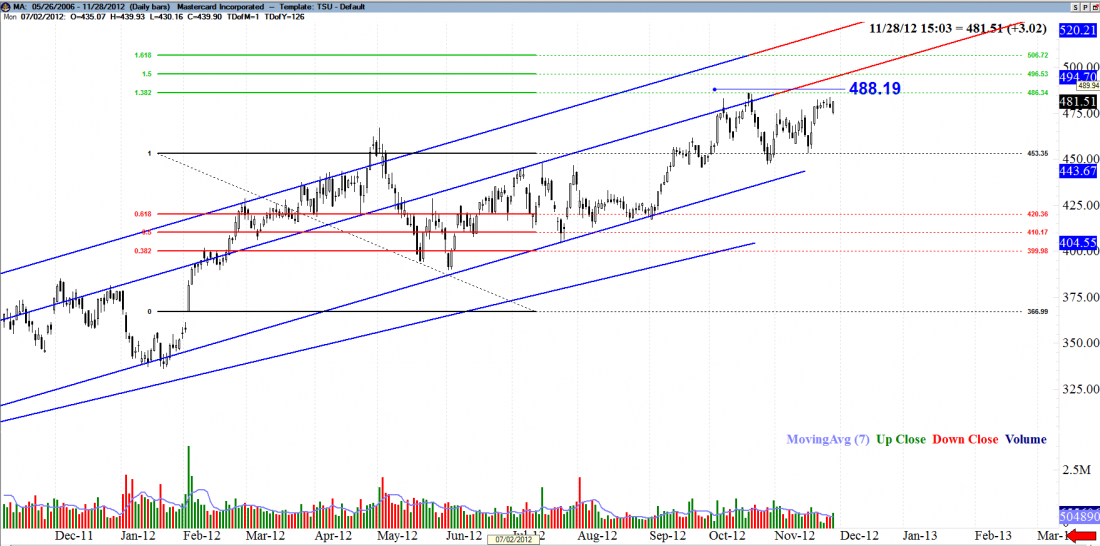

Well, as far a stock performance is concerned, not to bad at all. It’s in all time high territory on a pretty sustainable bullish trend. As of November 16 MA has made a higher low. We haven’t made a higher high relative to October 17, 2012 yet but it really could be right around the corner.

THE SET-UP

I currently have a Fibonacci expansion set up on MA. I have a trigger at $488.19 which is above the 1.382 extension. If we do get a close above $488.19 I would consider this a high probability trade, at least for a little while.

PLANNING THE TRADE

What I’ve noticed is that if and when a stock or ETF gets a close at an all time high, the stock usually moves another 1-3% before having another small retracement. So, if the stock moves 1-3% that correlates to about 10-30% move on an option. Mastercard has great open interest for January calls and decent open interest for April call options. Therefore, my likely target is a tad before the 1.618 extension. If MA moves up to the $502.00 area that would be an approximate 3% move on the stock. It also corresponds with the fib extension and bottom of a trend line. The goal I have in mind is to make 10% on 30% of my position, 15% on the other 30% of my position and 20% of the remaining 40% of my contracts.

RISK MITIGATION

Depending on when this triggers, I would place my stops below recent candle lows. If you are an investor that owns shares of MA, at least 100 shares, the $500.00 area would be a great location to sell Dec or Jan covered calls. Right now, you could gain $2.76 per 100 shares for a December expiration.

BE SMART

Trading really should not be stressful. Ensure your analysis confirms with mine and trade your plan. Thank you for all your support and great trades these past few weeks. I will see you (figuratively) again next week!