U.S. dollar strength and commodity weakness is starting to have a negative influence on the stock market.

PLAYING DEFENSE

Sector leadership has switched defensive over the last few weeks with Consumer Staples XLP, Utilities XLU and Health Care XLV outperforming.

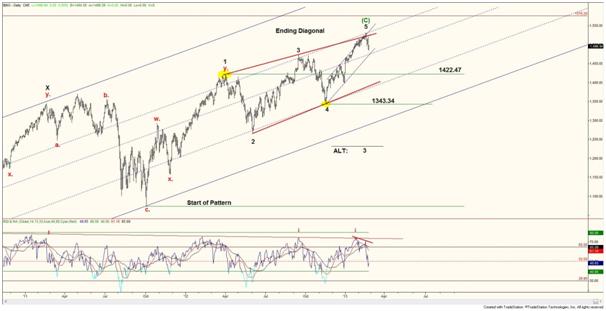

This defensive intermarket rotation is lining up with a potential trend terminating pattern in the S&P 500, a so-called “Ending Diagonal.”

WHAT IS IT?

The Ending Diagonal is a five wave Elliot Wave (EW) termination pattern that takes a wedge shape within two converging lines. Once it has ended it is followed by a swift move that retraces the entire diagonal triangle and possibly more.

The S&P 500 can be counted as having completed one of its alternate counts from the March 2009 low that appears to be culminating with such a pattern. The recent weakness in price has coincided with a break outside and now a close inside the upper trendline (known as a Throw Over) of what can be labelled as an Ending Diagonal.

Even if this high is only the third wave of the required five (See ALT: 3), price should push below 1,422.47 to get back into the territory of the first wave (a rule for the internal waves of the pattern). Follow through and below 1,343.34 would favour the fifth wave (Minor 5 black) to be complete and the early stages of a trend reversal potentially underway.

LOW RISK/HIGH REWARD SET-UP

The current drop off the top counts well as a lower degree five, how it builds from here remains to be seen, a three wave correction that stays below last week’s swing high is a requirement for the bearish forecast. This is a good example of a low risk high reward EW trade set-up.

Things could get volatile from here.

[Editor’s note: Madden tracks the intermarket wave counts at www.elliottwaveireland.com ]

= = =

Related story: