While fellow home furnishings and improvements company, Lumber Liquidators, deals with a plunging stock price on allegations of Chinese laminate wood flooring that contains high levels of formaldehyde, Restoration Hardware continues to thrive. The $3.6B company issued stronger Q4 guidance on February 5th (earnings due out in three weeks), to the tune of $1.00-$1.01 per share in EPS on revenue of $583M (both above estimates). Comps were for +24% vs the +19.5% consensus (+48% on a two year basis).

The stock does trade at a P/E ratio of 30.48x (Jan16 estimates), but the 27%+ earnings and 20% sales growth more than justify the above average multiple. On a price to sales basis Restoration Hardware trades at 2x and 5.5x on a price to book basis. Using that $3 per share estimate, even at $100 the stock would be trading at a PEG ratio of just 1.19x (2x is consider expensive).

Wall Street analysts remain bullish with an average price target of $97.84 (5 hold ratings, 10 buy ratings, 0 sell ratings). In February, both Cowen ($108 PT) and Telsey Advisory Group ($110 PT) initiated the stock with an outperform rating.

The retailer has actually taken the opposite approach and was awarded the GREENGUARD Certification for their line of baby and children’s furniture, meaning less toxic paints, glues, etc. As of November 1st, they operated 86 retail and outlet luxury stores in US and Canada.

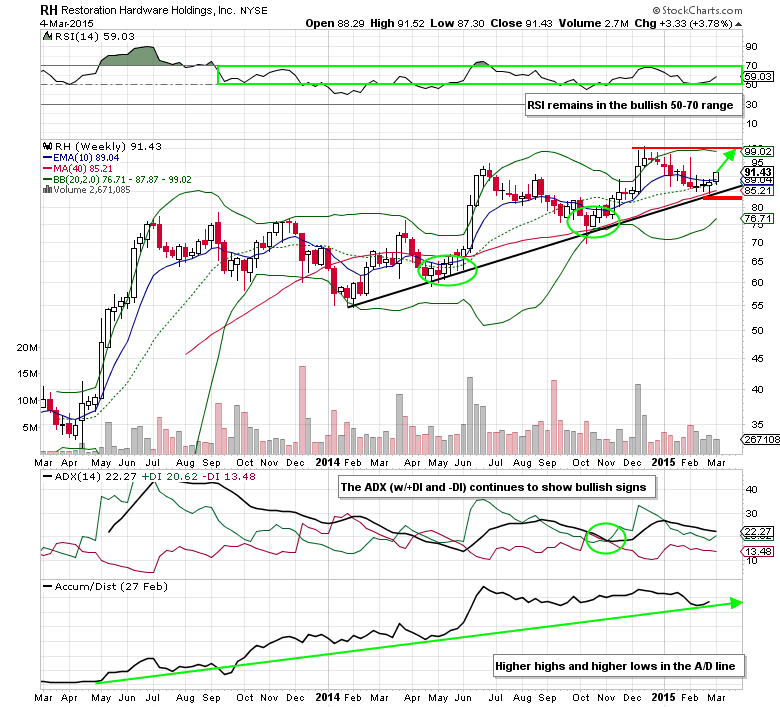

RH shares recently bounced off of long-term support at the year-long uptrend line (also the 40-week simple moving average). This sets up for another test of the $100 level in the next 1-2 months, although this time it is coming from a higher base, which could lead to $105+ before seeing a correction. To keep risk in check, a stop loss on a long stock position can be placed just below $84 ($84.26 was last week’s low).

Restoration Hardware Options Trade Idea

- Buy the Apr $90/$100/$110 call butterfly for a $2.60 debit or better

- (Buy 1 Apr $90 call, sell 2 $100 calls, and buy 1 Apr $110 call, all in one trade)

- Stop loss- None

- Upside target- Take profits on a move to $100 (maximum gain is $7.40)

Disclosure: I may buy this call butterfly sometime this week.

#####

To read Mitchell’s “Traders Bet On More Downside In The Oil Drillers”, please click here.”