Last week, we presented our forecast for the U.S. Dollar Index to climb between now and 2017. The corresponding path for the Japanese Yen should point generally lower, but we expect the move to be less direct. That sets up several possible trades during the next few years, and the next one may be just around the corner.

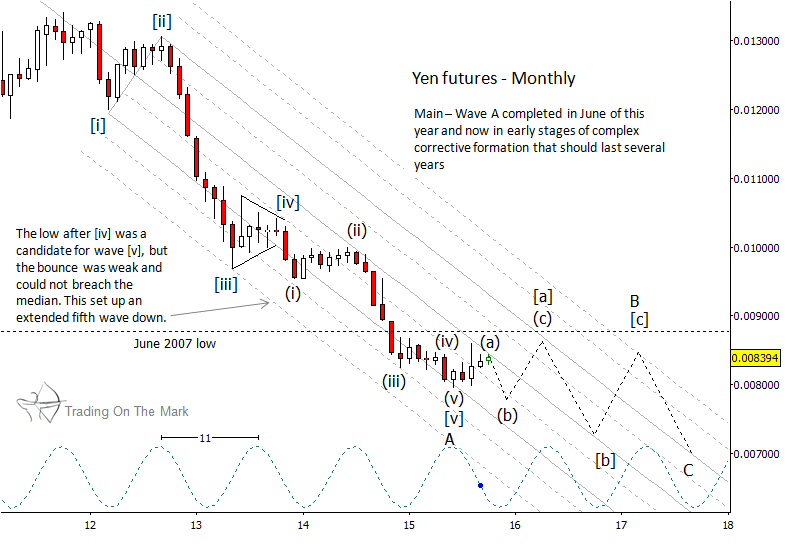

One of the clues about the path forward can be found in what the Yen did late in 2013. At that time, we believed the Yen might bounce more strongly from the late-year low. Instead, the Yen produced only a weak bounce, followed by a strong press lower. In other words, downward wave [v] extended, pushing the Yen below its 2007 low, and thus important support became resistance.

With the low that the Yen reached in June 2015, the downward wave count appears complete with five sub-waves. We would expect a corrective pattern to develop next, and the rally in recent months was probably the first small part of that correction. The overall corrective ‘B’-wave pattern from the recent low should take a three-wave [a]-[b]-[c] form, and traders may even be able to ride the smaller sub-waves within that pattern. If this analysis is correct, then the corrective ‘B’ wave should be followed by another sharp move down in wave ‘C’ a few years hence.

Even without the labels for the wave count, traders can take advantage of the resistance areas defined by the channel, which has worked very well since 2012. Combining channel geometry with the dominant 11-month price cycle shows where the next turns are most likely to occur. We have drawn a speculative path forward in alignment with the channel, the price cycle, and our working Elliott wave count.

Join us at Trading On The Mark to get timely information about trading opportunities.