Monday was an interesting day in the market. While the Dow closed down 276 points, 89 members of the S&P 500 finished up on the day. Apple, along with numerous energy plays, was a surprise member of this cadre of outperformers.

This show of strength is notable because Apple’s performance has been disappointing in a relative sense over the last few months. Shares looked promising toward the end of November, but the stock failed to surpass the $120 mark and that level became a Waterloo for the IOS bulls.

Instead, Apple has been a downside leader, shedding 20% of its value in just one month. That’s more than $100 billion in market cap, but I suspect that this capital did not leave the market entirely; rather it simply rotated out of AAPL and into the FANG gang. And on Monday that cycle was reversed.

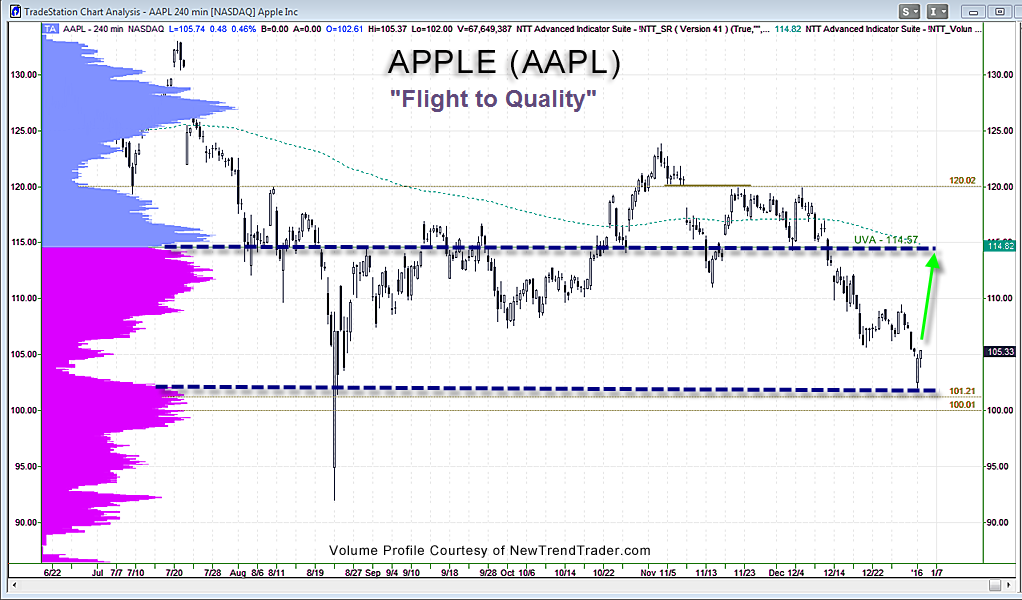

While I don’t expect AAPL to reach $120 any time soon, the $114 level beckons. That’s where AAPL would encounter its 200 day ema as well as the Upper Value Area (UVA) boundary, in Volume Profile lingo.

The fact that AAPL is trading below the UVA means it is in a fair value zone, which is presumably why it served as a market leader in the last hour of trading on Monday. I consider this rally in Apple to represent a simple flight to quality after a mini-bear market. After all, the stock has a trailing 12 month P/E of 11. Good bye FANG, hello Rotation.

www.daytradingpsychology.com (Peak performance coaching for private traders)

www.trader-analytics.com (Services for RIAs, banks and hedge funds)