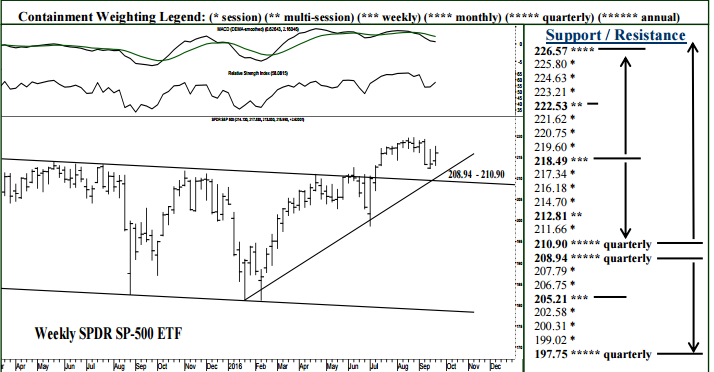

For the week ahead, 218.49 can contain weekly buying pressures, below which the SPY remains vulnerable over the next several weeks to testing long-term support at 208.94- 210.90. Downside this week, 212.81 can contain multi-session selling pressures (i.e., into later week), while a daily settlement below 212.81 indicates 208.94-210.90 within several days, able to contain selling through the balance of the year and above which a secondary long-term buy signal remains firmly intact. Upside this week, a daily settlement above 218.49 (especially early in the week) allows 222.53 by Friday’s close, while a weekly settlement Friday above 218.49 resumes a bullish trajectory into October, 226.57 then considered a 2-3 week target, able to contain monthly buying pressures when tested.

NEXT 3-5 WEEKS

The 208.94 – 210.90 area can absorb selling through the balance of the year, above which 231.11-231.89 remains a 3-5 month target (pg 2). Upside, 218.49 can contain weekly buying pressures, with a weekly settlement Friday above 218.49 indicating 226.57 within several weeks, also likely to contain monthly buying pressures when tested. A weekly settlement above 226.57 indicates the targeted 231.11-31.89 region within another 3-5 weeks where the market should top through the balance of the year. Downside, a weekly settlement Friday below 208.94 indicates a good annual high, 197.75 then considered a 3-5 week target able to contain selling through November.

THE NEXT 2-3 MONTHS AND BEYOND

The 208.94 – 210.90 region should absorb selling through the balance of the year, above which a secondary long-term buy signals remains in effect, expecting 231.89 within 3-5 months, an ascending long-term channel top currently at 243.15 over the next 8-12 months where the SPY can top out through 2017 (page 2). Downside, a weekly settlement back below 208.94 would scream “failed long-term buy signal”, essentially a valid sell signal over the next 3-5 weeks into the 197.75 region where the market should bottom out through November. Nonetheless, by closing the week below 208.94 the SPY opens itself up to testing 183.73 within 3-5 months

To receive a two week free trial of the Daily Futures Letters and Monthly Futures Wrap, CLICK HERE