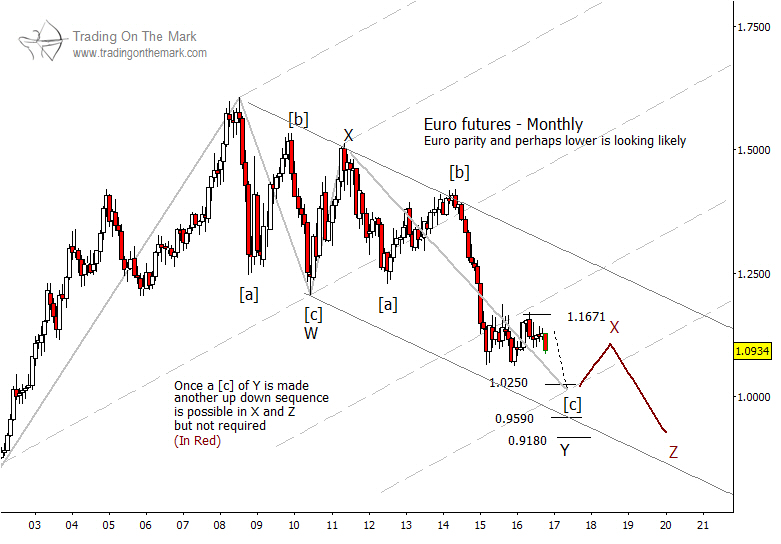

We continue our focus on currency futures in our posts and our newsletter this month. In contrast to our near-term bullish forecast posted last week for British Pound futures, we believe the Euro is still working on a decline that should take it to near parity with the U.S. Dollar within a year. Our basic forecast for the Euro has not changed from what we presented here at Trader Planet in March 2016, although we have been able to refine some of the resistance and support levels that we think traders should watch.

The Euro appears still to be working on a large, complex corrective move down from its 2008 high. In that scenario, Elliott wave pattern completion should require at least one more substantial decline to make a lower low and to finish sub-wave [c] of ‘Y’.

Going forward, we would like to see the Euro remain beneath resistance at 1.1671. In coming months, it should attempt to test one or more of the Fibonacci support levels shown at 1.0250, 0.9590, and 0.9180. Traders should watch the higher one of those levels carefully, because it might coincide with a test of a bigger-picture upward-sloping channel that is revealed by use of Barrie Hetirachi’s “five point pattern” tool. If the upper support breaks, then the next support level could coincide with a test of the simpler downward-sloping channel that has guided the decline since 2008.

When the Euro eventually finds support sometime during the next year, that still will not seal the deal for the correction to be finished. Since the pattern has already proved to be complex-corrective, it could still afford to make another bounce followed by yet another lower low several years hence. We have drawn a speculative path for a longer-duration correction on the chart, but it is too early to trade that scenario. For now, traders should simply look downward for the next several months until at least one of the supports is tested.

There’s more! Our newsletter this month will focus on currency futures and related ETFs. Request your copy via this link!