Open every new article and it seems everyone is predicting ‘doom and gloom’. Do I think so as well?

This is a question I am constantly asked by my blog readers which is why I wrote a piece several months ago post the Greek Debt crisis titled, Is Another Global Financial Crisis Starting Now?.

Sure the technical charts seem ugly, but the reality is, fundamentals are what drive value and prices in the long term, and not charts. Using technical charts before fundamentals is like having the tail wag the dog. I like to use both, but my priority is always fundamental analysis first, then technical analysis second.

I will repeat myself here again. I don’t like to predict because I am usually right in the short term only 50% of the time, which really isn’t much of a prediction, but go medium to long-term, and my probability of being right dramatically improves.

What I do like to do is look at the market as well as stock fundamentals and investigate if there exists any catalyst which will drive the markets down hard and truth is, I haven’t yet found one.

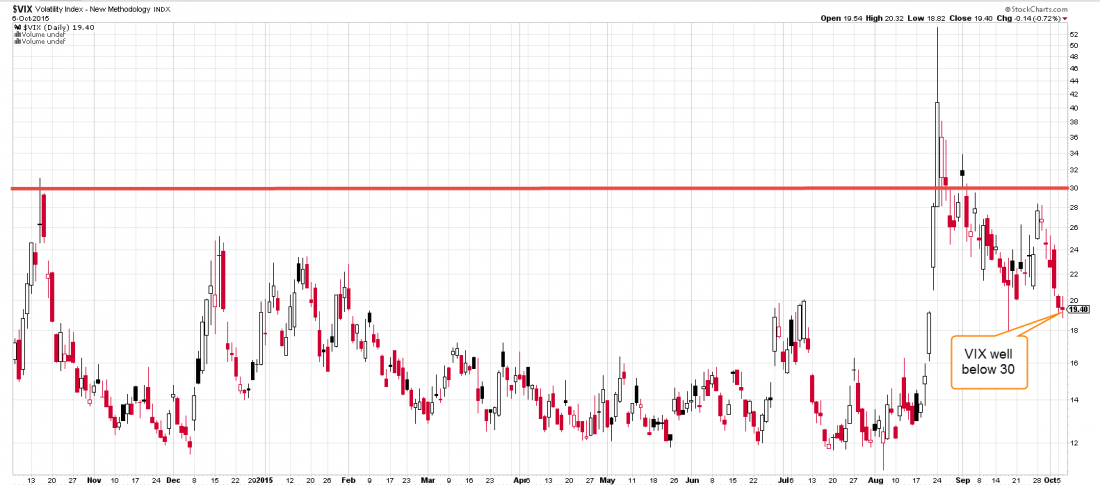

The volatility index VIX seems to now be back to normal and well below 30, and the US and European 2 year interest rate swap spreads continue declining which generally means overall market liquidity is good.

This pretty much sums up the unlikelihood of a doom and gloom recession in the near horizon.

Is there one perhaps in a couple of years’ time? Sure there is that possibility.

But for now, I will continue staying my course and buying up great global business franchises which its prices have recently fallen within value and usually with a high degree of a margin of safety.

The recent Chinese market scare produced an incredible large amount of bargains for many to take advantage of, if you were willing to do a little bit more work looking at the ‘back end’ of the market and not be influenced by the media and doom and gloom journalist who try to justify every market movement with a reason.

Sometimes, movements are nothing more than random noise which Warren Buffett calls, the emotions of Mr Market.

Remember: Be fearful when others are greedy and greedy when others are fearful.

Live by this and not only will you do quite well in the markets, but you also preserve your sanity in the never ending deluge of unnecessary market noise.

Find out how you can safely increase your returns, even in volatile markets, click here.