I stand corrected and I do not mind admitting it. The past few weeks, I have been suggesting that December Gold would see short dips being bought and would likely rally through $1800 an ounce in the near future. We begin this week trading below $1750 an ounce and I am somewhat surprised. While today’s low is seen as a decent support level off of the September 26th price, I am still left questioning whether Gold’s hangover will continue.

Normally I try to fill this report with a review of last week’s fundamentals to explain the trade, but I will spare you the boredom. Here is a “Cliff’s Notes” version of the reports and action last week from the United States, Europe, and China. In the United States, the idea of QE3 (printing US Dollars and purchasing debt) has now officially faded as most markets have corrected the move up. On top of that, the huge Michigan Consumer Confidence number only resulted in a thirty second rally, followed by a selloff to finish the week. In Europe, there is one thing only to report. That is that for the sixth week straight, the market continues to worry about whether or not Spain will request a bailout and allow the ECB to buy Spanish debt and reduce borrowing costs. Thankfully, none of the traders that I know are holding their breath waiting for a final answer from Spain. And in China, the reports continue to be one question mark after the next. So what are we left with? We are left trading technicals in lighter volume that are still driven by HFT programs. I believe that if we do not hear about a formal request for a bailout from Spain soon, that we may have to wait until after the US Presidential Elections before the market environment changes.

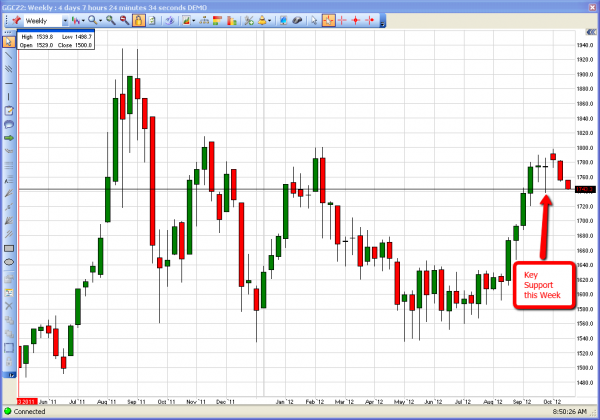

Technically, many of the major markets (especially major Currency Futures like the Dollar and the Euro) have been trading themselves into tighter and tighter ranges over the last few weeks. I will be looking for any confirmed breakouts in the Euro and Dollar as indicators for the Gold Trade. Also, the December Gold Weekly chart shows that we begin this week testing an important support from late September. If we break this support

level, I will first make sure the selloff was not merely a stop hunt, then decide whether the market will rally from this support or try to test $1700 an ounce in the early part of this week.

I still believe that Gold Futures will trade above $1800 an ounce in the near future. This week will definitely test any Gold Bugs patience, but ultimately I believe the bulls will prevail.

As always, please feel free to call or email me directly to discuss trading in the futures market. Or if you wish to speak with me about this report, you can reach me directly at (888) 272-6926 or by email at bbooth@longleaftrading.com. I will be happy to hear from you.