The big news this morning in the crude oil complex isn’t necessarily Friday’s reversal. The big story is how long will the United Steelworkers union strike? According to Bloomberg, they have unionized employees at more than 200 U.S. oil refineries which are responsible for 64% of U.S. fuel production. The current strike situation affects about 10% of daily U.S. production. This is the first major strike in the oil sector since 1980. This type of generational situation should provide some credence to the severity of the price decline in the oil market, as well as how important this industry has so quickly become to middle-class America.

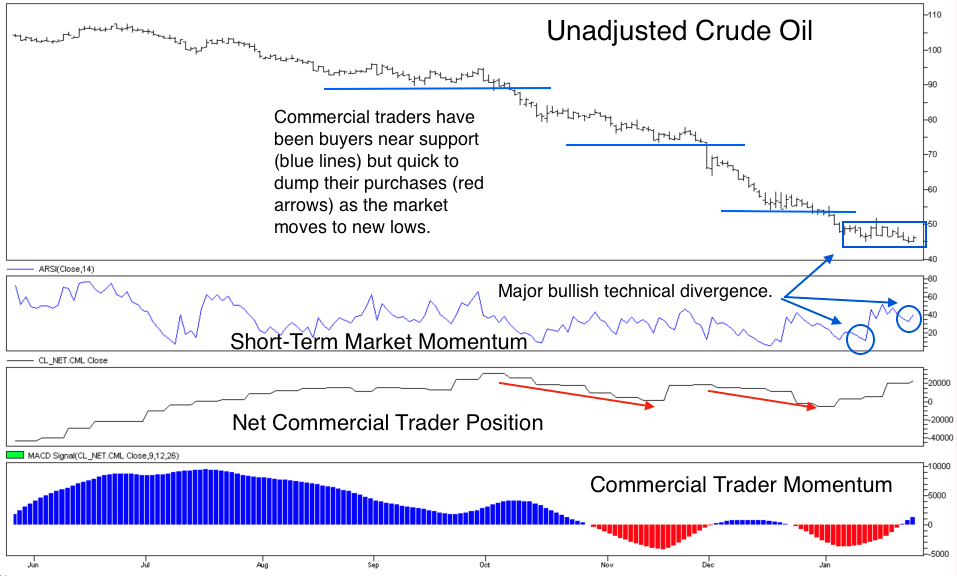

This background sets the stage for today’s technical action. Throughout the crude oil market’s decline, we’ve seen the market fall, stall and fall again. You can see the support levels illustrated by the blue horizontal lines on the chart below.

Notice that each of these support levels has been accompanied by an increase in the commercial-trader net position in the third pane of the chart. As the support levels have been breached, the commercial traders sold off their previously purchased contracts while waiting for another opportunity, as shown by the red arrows. The recent action in the mid-$40’s may have finally turned the tide.

The month of January has been sideways and choppy in a market that has declined substantially, already. The recent flush in the April contract below $45 per barrel triggered an influx of supportive commercial buying. Commercial traders have gone from net short nearly 5,000 contracts at the beginning of January to net long approximately 22,500 contracts, currently. This shift in commercial traders’ perspective has turned their momentum positive. It has also created a bullish technical divergence, as measured by our short-term market momentum indicator.

When we combine this with a bottoming commercial outlook on prices, it provides the type of fundamental and technical trigger that we like to use for entering a mean reversion trade. We expect the current lows to hold and the market to push higher over the next two weeks as the lawyers argue and commercial end-users take up future supply at the current prices.

#####

For more from Andy Waldcock, please click here.