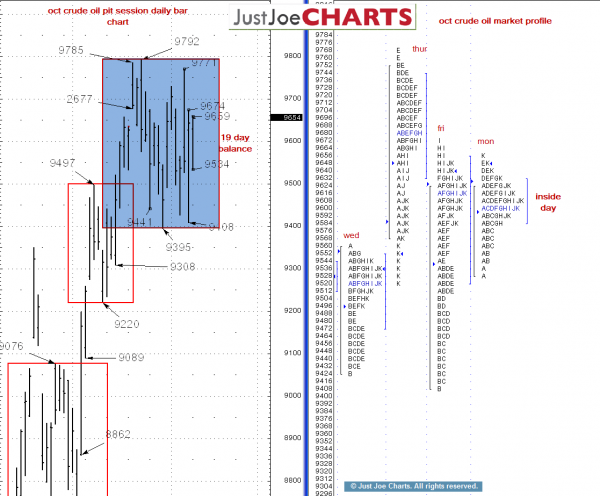

October Nymex crude oil futures have been trading within a relatively tight $93.95 to $97.92 balance bracket for the last 19 days. Additionally, Mondays inside day, (Monday’s range was within Friday’s range) is another form of balance. An inside day within a 19 day relatively tight balance bracket is “balance within balance.”

BE READY FOR A BREAKOUT

When a volatile market such as crude oil is contained within such a tight balance for an extended period of time, a significant move usually follows the breakout from that balance.

FIRST STEP

The first step is to see which way the market breaks from the “inside day.” If the market breaks from Monday’s inside day to the upside day, the likely scenario is that it tests the $97.92 balance bracket high. If the market breaks from the inside day to the downside, the likely scenario is that it tests the $93.95 balance bracket low.

SECOND STEP

The second step is to gain so-called “acceptance” outside the $93.95 to $97.92 balance bracket.

KEY LEVELS

The market may or may not remain within this balance bracket for the time being, but its best to be prepared for when the break from balance happens. If the market gains acceptance above the $97.92 balance bracket high, $99.09 and $100.68 are the next upside references on the weekly/monthly charts.

If the market gains acceptance below the $93.95 balance bracket low, $93.08 and $92.20 are important references to watch for.