While the market continues to behave just fine, the worry warts are still a vocal bunch, content to talk about reasons why the stock market will face turbulence ahead. True, there are many issues still unresolved on Capitol Hill when it comes to the deficit and spending cuts, but in case you hadn’t noticed, market sentiment has gotten a lot of better, which is why I’ve put a few buys out there recently for the Ultimate Growth Stocks model portfolio.

GO WITH THE FLOW

It’s called swimming with the market tide. Last week’s bullish gap up by the Nasdaq Composite in higher volume — and equally bullish move by the S&P 500 — was an unequivocal sign of institutional buying and brings a retest of the September highs into play. There may one last shakeout before a breakout, but the pieces seem to be in place for more strength.

DON’T CHASE

Be careful about chasing stocks that have quickly become extended in price. Stocks in this boat include new market darlings 3-D Systems (DDD) and Stratasys (SSYS) as well as names like Qihu 360 Technology (QIHU), Fleetcor Technologies (FLT) and Yahoo (YHOO). Instead, focus on stocks that are basing or still within buying range after recent breakouts. They could have more left.

TOP PICK

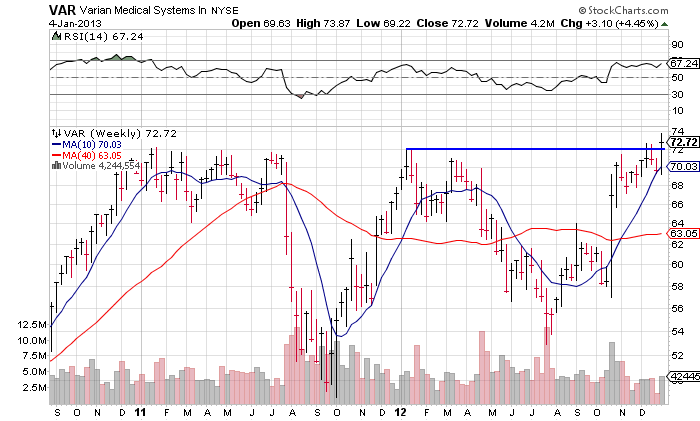

One name that comes to mind is Varian Medical Systems (VAR). The company makes oncology systems and equipment used in radiation therapy. It has a market capitalization of nearly $8 billion and trades close to 1 million shares a day. The company has a consistent track record of earnings growth and annual return on equity is exceptional at 31%.

Fundamentals are solid, although sales growth has been decelerating in recent quarters. I’m willing to cut it some slack, however, because sales growth is expected to re-accelerate when the company reports fiscal first-quarter results after the close on January 23. The consensus estimate calls for profit of $0.79 a share, up 10% from a year ago with sales up 8% to $676 million.

CHART VIEW

Technically, Varian looks good. After two down weeks in light volume where it didn’t give up much ground, shares popped 4.5% last week in higher volume. Shares remain under accumulation as the stock vies for a bona fide breakout from a long base. Recent strength in the market has resulted in a lot of extended stocks, but Varian Medical isn’t one of them.

= = =

See more trading ideas in our Daily Markets section.

Feature Story–learn a new trading strategy here:

Trend Following: Low Risk Breakout Strategy