China celebrated their 2012 New Year with the symbolic dragon. All prospects for the country and the economy were looking prosperous but there seems to be a divergent trend from expectations.

WHAT’S NEXT?

2013 is the year of the snake and those born under this sign tend to calm, determined and passionate. As we slither into the New Year the hopes and dreams of China’s growth may hinge upon how the government balances a very delicate economy.

GLOBAL LEADER

This year we have seen China contract from the sky high growth rates of the previous decade. Perhaps they are just starting to mature, no longer an emerging economy. Better yet, the country is fast becoming a symbol of global growth and increasingly relied upon to carry the heavy burden of global leadership along with the United States.

IT’S STILL ENVIABLE GROWTH

I chatted recently with my colleague and friend Stephanie Link, who manages Action Alerts Plus for Real Money and she concurred saying “China’s growth is still robust and is enviable when compared to the U.S. and Europe.” Link continued, “Inflation has come down from very high levels and is poised to settle down as China contemplates more stimulus via bank rate reductions.”

BIG INFRASTRUCTURE PROJECTS

Recent China statistics highlight that the economy is probably slowing down. Since July the government has announced bold infrastructure projects and initiatives designed to drive growth, which will create new jobs and build out cities to create a more modern living environment. No other country in the world has the capacity or the need for such an upgrade.

THE TRADE

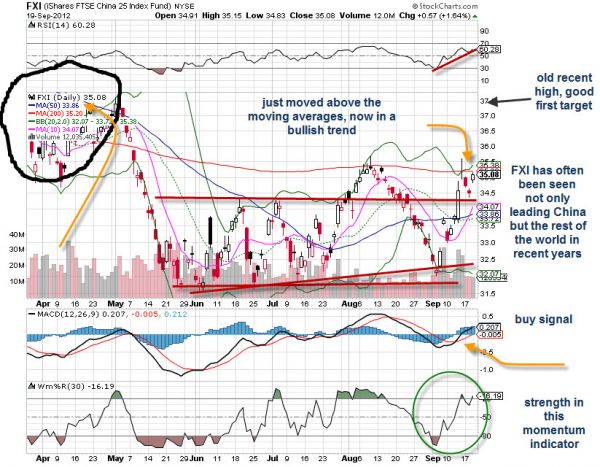

The iShares FTSE/Xinhua China 25 Index ETF (FXI) represents China stocks, a mixture of mainland China and Hong Kong names. See Figure 1 below. There is a wide trading range yet it appears with some effort price is ready to forge higher.

IT’S A LEADER

Historically, the FXI has led the economy by four to six months. If this breaks out of a range we’ll see if this portrays a strong China as the Dragon morphs into the Snake in 2013.

Looking for more trading ideas? Read our daily Markets section here.