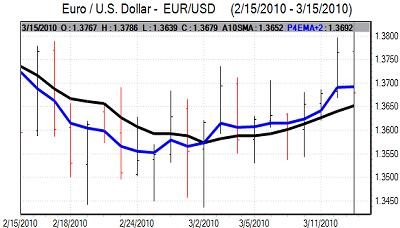

EUR/USD

The Euro edged slightly lower in early Europe on Monday as risk appetite was generally weaker. During the day, the Euro also registered sharp losses on the crosses which was an important factor in pulling it weaker against the dollar.

As underlying tensions surrounding the Greek debt situation persist, the meeting of EU Finance Ministers will be watched very closely on Tuesday to assess whether officials have been successful in easing market fears surrounding a sovereign debt crisis. Any evidence of renewed tensions would be an important negative factor for the Euro.

The latest New York manufacturing PMI index edged slightly lower to 22.9 for March from 24.9 the previous month, but this was still a historically firm report and the employment component also improved. In contrast, the latest NAHB housing index dipped to 15 from 17 the previous month, maintaining the recent run of disappointing figures surrounding the housing sector.

The latest long-term capital inflows data recorded lower than expected inflows of US$19.1bn for January from US$63.3bn the previous month, but the market impact was limited.

There will be a one-day FOMC meeting on Tuesday with the announcement due after the European close on Tuesday. There is likely to be pressure from some regional Fed Presidents to signal a tighter policy. There is likely to be more significant support for a slight change to the language used by the Fed with pressure for the phrase that interest rates will be kept at exceptionally low levels for an extended period to be removed or at least modifed.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Chinese premier Wen warned in weekend comments over the risk of a double-dip downturn within the global economy and tensions between China and the US over trade and the yuan were also generally higher. In this environment, risk appetite was weaker and the yen was able to resist selling pressure.

There will still be expectations of further Bank of Japan policy relaxation this week which will tend to limit yen buying support and the dollar was able to consolidate just above the 90.50 level in Asian trading.

The dollar edged slightly higher during the US session on Monday with expectations of further Bank of Japan action an important factor curbing advances for the yen.

Sterling

Sterling dipped lower on Monday following a warning from Standard & Poor’s that the UK has moved substantially closer to a credit-rating downgrade.

There was also still a high degree of political uncertainty with the latest opinion polls still suggesting a high risk of an indecisive election result. The latest Rightmove house-price index also recorded only a marginal increase for March which is normally a robust month and this maintained unease over the housing sector.

MPC member Barker stated that there was a risk that the UK economy could see a quarter of negative growth which added to negative sentiment surrounding the economy.

The UK currency initially proved resilient as there was further evidence of speculative short positions being covered, but there were sizeable losses against the dollar during the European session. Sterling did find support just above the 1.50 level and managed a fragile corrective recovery. Underlying sentiment remained weak as the negative fundamentals continued to sap currency support, but there was support beyond 0.91 against the Euro.

Swiss franc

The dollar found support below 1.0580 against the franc on Monday, but found it very difficult to make headway despite its gains against the Euro. The Swiss currency was strong on the crosses which curbed dollar support as the Euro dipped further to test support levels near 1.45.

There was further speculation that the National Bank would soften its stance against intervening to curb franc strength and this was an important factor in pushing the currency stronger during the day.

Volatility levels are liable to remain high in the short term, especially as the central bank could certainly intervene to discourage speculative Euro selling.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

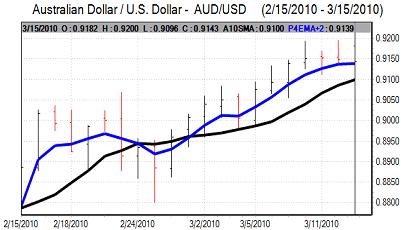

Australian dollar

The Australian dollar initially held firm on Monday, but it was unable to sustain the gains and dipped back towards 0.9130 against the US dollar as equity markets were weaker while commodity prices were also generally lower.

The currency found support close to this level and managed to push higher as equity markets looked to rally later in New York trading. There was still some unease over the risk of further Chinese policy announcements.