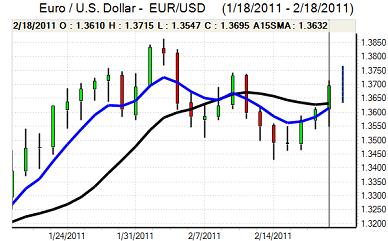

EUR/USD

The dollar strengthened during European trading on Friday with a brief move to near 1.3550, but it was unable to sustain the advance and weakened back to the 1.3620 area. In contrast, to the previous session, the Euro found additional buying support at higher levels and pushed strongly higher to a peak just above 1.37 before consolidating weaker ahead of Monday’s US holiday.

The Euro was supported by comments from ECB member Bini-Smaghi who stated that the ECB could have to consider an early tightening of policy if global inflationary pressures build. Markets had toned down their expectations of ECB tightening following more balanced remarks at the last monthly press conference and Bini-Smaghi’s comments triggered some fresh increase in speculation, although the impact is likely to have been exaggerated by thin conditions into the long holiday weekend.

There were further tensions both in the Middle East and North Africa with a particular focus on Libya while there have also been some protests within China. The dollar again failed to draw any safe-haven support from the tensions, but there will still be the potential for gains if there is a sustained flow of funds out of emerging markets.

Within Germany, the government suffered a heavy defeat in Hamburg local elections and this will maintain pressure on Chancellor Merkel to take a hard-line stance on Euro-zone debt and bailouts. There were elevated borrowings from the ECB emergency funding facility on Friday for the second day running. There were also reports that this may have been related to a winding down of two Irish banks which would lessen the potential impact, but there will still be unease over the European banking sector which will pose important Euro risks.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar failed to make any impression on the yen during Friday with resistance above 83.50 and it retreated to lows close to 83.00 before finding some degree of support.

The G20 meetings did not have a substantial market impact with members pledging to tackle global imbalances, but not taking any definitive steps. During Friday, the Chinese central bank also increased its commercial bank reserve requirements again with a rise to a record 19.5%. The market impact was again limited, but is likely to have some impact in boosting defensive demand for the Japanese currency.

Any further deterioration in risk conditions would also tend to support the yen, although the impact may be limited at this stage. Underlying confidence in the Japanese fundamentals will also remain weak which will limit buying support and the dollar was little changed in subdued Monday trading.

Sterling

Sterling held steady ahead of the retail sales release on Friday and then pushed higher following the monthly 1.9% jump in sales even though December was revised to show a 1.4% decline. Sterling was unable to sustain an advance against the Euro, but did push to a high just above 1.6250 against the dollar as the US unit remained on the defensive.

There was a reported 3.1% increase in the Rightmove UK house-price index for February, but this measures asking prices rather than selling prices and there have been further media reports that prices will drop during 2011 as fiscal tightening takes effect, especially as mortgage lending data remains weak. Interest-rate speculation will continue to be a very important market influence with the Bank of England minutes on Wednesday.

Underlying confidence in the UK economy is still liable to deteriorate over the next few weeks which will provide a stern test of Sterling confidence, especially if wider risk appetite deteriorates.

Swiss franc

The Euro advanced strongly to a high near 1.2990 against the franc on Friday, but was unable to hold the gains and weakened back to the 1.2920 area. The dollar was blocked close to 0.9550 and dipped to lows near 0.9430 during US trading which was the lowest level since early February.

Risk appetite conditions will continue to be watched closely and the franc will gain some further support if tensions surrounding the Middle East intensify. The Swiss currency is also likely to be seen as the ultimate safe-haven currency, especially with major doubts surrounding the Euro-zone and US economies.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

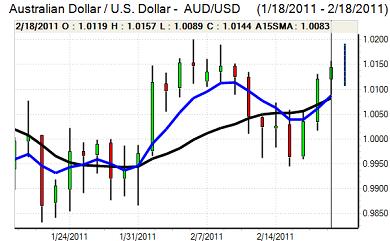

Australian dollar

The Australian dollar found support just below 1.01 against the US currency on Friday following a further increase in Chinese reserve requirements and pushed to a high just above 1.0150 as the US currency came under wider selling pressure.

The Australian dollar was unable to capitalise on the move and dipped weaker again in local trading on Monday. Underlying risk appetite remained more cautious which hampered the currency and there will be important risks to the currency if emerging-market tensions intensify. There will also be the risk of additional volatility if China takes further monetary steps.