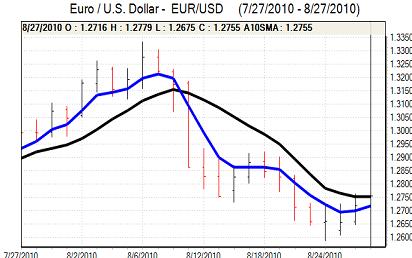

EUR/USD

The Euro found support below 1.27 against the dollar in European on Friday as markets consolidated ahead of key event risks later in the US session.

US second-quarter GDP growth fell to 1.6% from a provisional 2.4%. As expected, a deterioration in the trade account was the prime reason for the downward revision while the other components were broadly in line with market expectations. There was some relief that a sharper downturn was avoided following a string of recent weak data releases.

Chairman Bernanke stated that the Federal Reserve would support the economy and was prepared to provide additional stimulus if required. He also stated that the central bank would be prepared to expand quantitative easing if needed. The comments helped underpin risk appetite with expectations that the Fed would do all that it could to support the economy.

The improvement in risk appetite helped support the Euro while the expectations of sustained support for the economy also maintained a defensive dollar tone on yield grounds. The Euro strengthened to test resistance levels above 1.2750, but the Euro was unable to make strong headway with some reports of selling by Asian central banks curbing support for the currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support on dips below 84.50 against the yen on Friday and the US currency gained some degree of support from the slightly stronger than expected US GDP report.

The US currency also gained some relief from Bernanke’s comments as underlying risk appetite stabilised with firm gains on Wall Street. There were some expectations that G7 would intervene over the weekend and this also curbed speculative yen buying.

There were expectations that the Bank of Japan would hold an emergency policy meeting on Monday and this also triggered a closing of long yen positions. There was a reduction in exporter selling as month-end selling eased while the dollar gained some technical support. Confirmation of a meeting in Asian trading on Monday pushed the US currency to a high around 85.80 in early trading.

Sterling

Sterling came under selling pressure in European trading on Friday with some unease over the domestic economic trends. The UK currency found support below 1.5450 against the dollar on Friday and maintained a firm tone in US trading as the US currency lost ground. As risk appetite improved, Sterling strengthened to a high just above 1.5550 against the US currency while the Euro held in the 0.82 area.

Bank of England MPC member Bean stated that the days of quantitative easing by the central bank may not be over and this maintained expectations that the central bank could decide that further stimulus may be required within the next few months.

The latest Hometrack housing index recorded a decline of 0.3% in the latest monthly survey and there will be persistent unease over housing trends which will tend to unsettle the UK currency. Dollar weakness remained a key influence and the UK currency held firm near 1.5550 in early Asia on Monday.

Swiss franc

The Euro found support near 1.30 against the franc on Friday and gradually recovered ground in the European session with highs near the 1.31 level. The US currency also found support near 1.02 against the franc and strengthened to a high of 1.03 on Monday. There was an easing of risk aversion as equity markets rallied which also curbed immediate demand for the Swiss currency.

National Bank member Jordan stated that the bank was following markets closely and there will still be some speculation that there could be intervention to weaken the Swiss currency which curbed immediate buying support.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

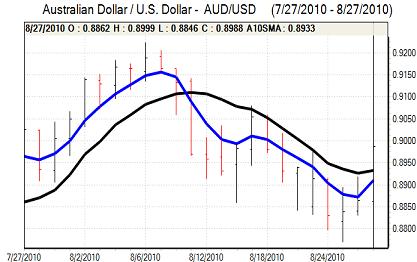

Australian dollar

The Australian dollar found support below the 0.89 level against the US currency and rallied in US trading following the US data and comments from Fed Chairman Bernanke with a high near 0.8980 area. Underlying risk appetite improved and this provided significant support for the local currency.

There will still be unease over the domestic economy, especially as there was a decline in housing sales according to the latest data. Underlying caution over the international economy is also likely to deter strong buying support for the currency.