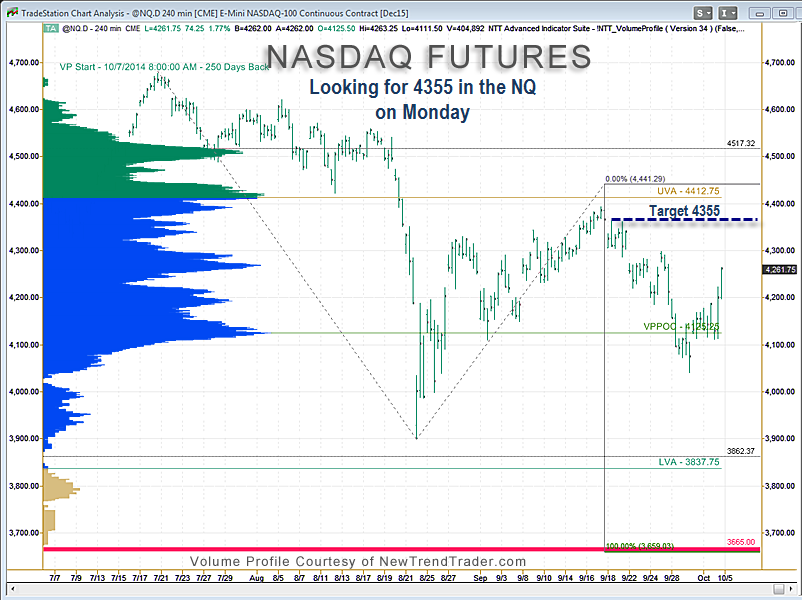

Early last week I wrote an article for TraderPlanet with a very bearish target for the Nasdaq futures (3665). On Friday, however, I noted that the Nasdaq (NQ) respected a key line in the sand at 4125, which is technically the Volume Profile Point of Control.

That level is the price at which the most volume over the look-back period occurred. In this case the look back period is an entire year, so this level has some significance.

One can use Volume Profile to help determine trend direction. Basically, if price is above a long term VPPOC, conditions are bullish and if price is below a key long term VPPOC conditions are bearish.

Although the lower target in the NQ may come to pass, the NQ should enjoy a continuing relief rally to at least 4355. If and when we head back down, 4125 will most likely be a critical support level zone.

To find out more about how to stay disciplined in this volatile market visit: http://www.daytradingpsychology.com/increasing-trader-discipline/