Kroger (KR) reported Q3 EPS of $0.53 on December 5th, a year over year increase of 15.21%. Revenue also saw an increase of 3.21% from Q3 2012 results. The management team reiterated FY13 earnings of $2.73-$2.80 per share. The P/E ratio currently stands at 14.57x this year’s earnings and a forward P/E of 12.98x 2014 estimates. Given the expected 11.50% EPS growth and 5.72% revenue growth for 2014, shares of Kroger could see gains north of 10% and still not be at an excessive valuation.

OPTIONS ACTION

One options trader took advantage of the implied volatility in the January 2015 options expiration (23.65) on December 11th and sold 2,000 of the Jan 2015 $32 puts for $1.05 each. He/she is making a mildly bullish bet that the Cincinnati-based retailer will stay above the $32 level into 2015. If the stock does he/she will get to keep the $210,000 worth of premium collected.

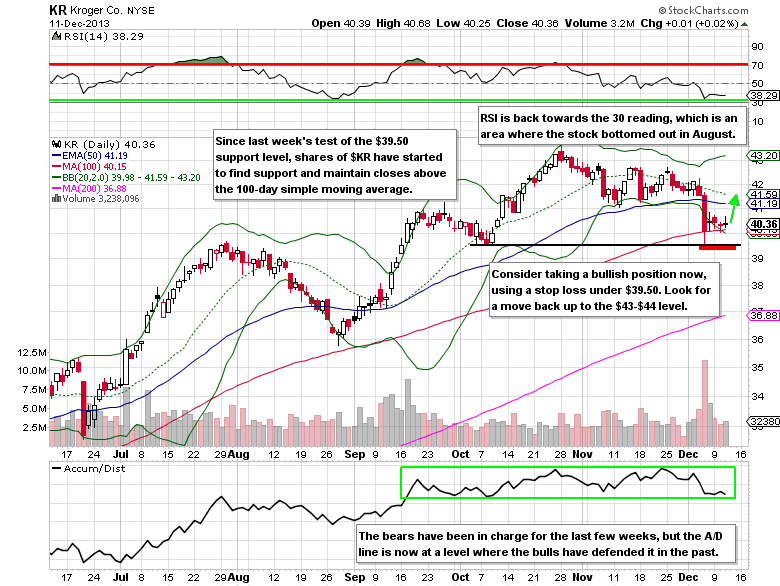

THE TECHNICAL TAKE

Kroger shares are down 7.60% since the all-time high print of $43.68 in October. However, following last week’s test of the $39.50 support level and the 100-day simple moving average, Kroger is now poised for a retest of the all-time high and possibly even higher. Given that the stock is less than $1 above current support, the reward/risk ratio is in favor of the bulls at 3.86.

KROGER OPTIONS TRADE IDEA

Buy the Jan 2014 $40 call for $1.20 or better

Stop loss- None

Upside target- $3.00-$4.00

= = =

See more: Mitchell’s Smart Money Report for unusual options activity featuring Yahoo (YHOO)