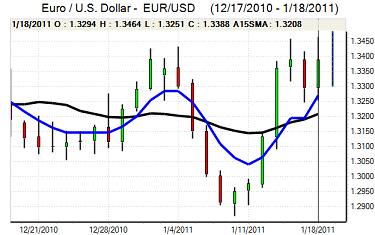

EUR/USD

The Euro hit resistance close to 1.3450 against the dollar on Tuesday and retreated to the 1.3360 area, but there was solid buying support on dips and it strengthened to a fresh 5-week high above 1.3480 in Asia on Wednesday.

The German economic data remained impressive with the ZEW business confidence index rising further than expected to 15.4 for January from 4.3 the previous month. The data will reinforce market speculation that the ECB will take greater note of inflation concerns, although the language from council member Weber was not overly hawkish.

Immediate fears surrounding the Euro-zone stresses have eased which is encouraging further short covering, but the underlying risk profile remains very high and there are still very important solvency issues which will maintain underlying Euro vulnerability, especially as yield spreads widened over the past 24 hours. There will also be unease over the implications of member states such as Ireland effectively printing Euros which will destabilise medium-term confidence in the currency and confidence towards the currency could still deteriorate rapidly, especially if stresses increase in Spain.

The US economic data fell marginally short of expectations with the NAHB housing index unchanged at 16 for December while the New York empire manufacturing index rose to 11.9 from 9.9. There is likely to be a greater focus on the US fiscal position in the short term, both at a Federal and State level and this will tend to leave the dollar exposed to some selling pressure.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar failed to advance above 82.80 against the yen during Tuesday and was then subjected to renewed selling in the Asian session on Wednesday as it retreated sharply to lows near 82.10.

The latest US capital account data recorded net long-term inflows of US$85.1bn for November from a revised US$28.9bn the previous month and this should provide some degree of support to the dollar with optimism over underlying capital flows. The US currency is still finding it difficult to gain further yield support and technical selling appears to have increased.

The series of Chinese economic releases will be watched closely on Wednesday and a lower than expected reading for inflation could weaken the yen slightly as underlying regional risk appetite would tend to improve.

Sterling

Sterling held firm ahead of the UK economic data on Tuesday and then pushed sharply higher as inflation dominated the news agenda. The headline consumer inflation rate rose to 3.7% for December from 3.3% the previous month. This was the highest reading for 8 months and there will certainly be fears that inflation will rise further given recent tax increases.

The inflation rise will also increase pressure on the Bank of England to tighten monetary policy. There was a substantial move in futures markets following the data with markets pricing in 3 interest rate increases to 1.25% before the end of 2011.

The data and shift in expectations pushed Sterling to a high above 1.6050 against the dollar, but it failed to hold its best levels. There will be doubts whether the bank will be in a position to increase rates significantly, especially with internal demand liable to weaken at the same time as credit supply remains weak. From a medium-term perspective, inflation is also a negative currency influence. The UK currency again tested resistance above 1.60 on Wednesday as it was supported by wider dollar vulnerability.

Swiss franc

The Euro found support on dips towards 1.28 against the franc on Wednesday and strengthened to a high above 1.29 on Wednesday. After rallying strongly from a trough near 0.9550, the US currency weakened again in Asian trading.

Immediate demand for the franc on defensive grounds has eased, in tandem with reduced fears over the Euro-zone solvency issues, and markets are also still looking to take a positive tone towards the global economy. There is still the potential for renewed flows into the franc if fears over the Euro-zone intensify again and volatility is liable to remain a key short-term feature.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar was trapped just below the parity level against the US currency during Tuesday, but there was a fresh push higher in Asian trading on Wednesday as the local currency strengthened to a high near 1.0050.

International US dollar weakness continued to support the Australian dollar and there were gains for metals prices which also had a positive impact during the Asian session. There was a sharp decline in consumer confidence according to the latest Westpac release, but this did not have a major impact with markets suspecting that recent flood damage distorted the data