This week’s piece is more newsworthy than a straight trade recommendation. As many of you know, we focus on the Commodity Futures Trading Commission’s weekly Commitments of Traders report. This report breaks down the market’s major players into a few manageable groups; commercials, speculators, swap dealers and small speculators. The record setting battle in the silver futures market is taking place right now, between the commercial traders and the large speculators. We’ll examine both sides and define an important difference between a battle and a war.

First, it’s important to analyze any strategy through the time-frame it is to be traded upon. We are swing traders and typically look for moves lasting two weeks or, less. This has led us on a multi-decade search to determine proper swing trading protocols. The touchstone of our research has led us to the conclusion that commercial traders win the vast majority of the battles however, the large speculators can marshal a sizable troop advantage. This advantage escalates the battle and always leaves a trail of tears in its wake.

Now, a brief background before we put the pieces together. The commercial traders are separated into two groups, Producers/Merchants and Processors/Users. These two groups correspond to silver producers and consumers, respectively. During the course of typical market moves, we look at the commercial trader balance to determine the relative value of given market prices. When Processors/Users are buying, we see silver as undervalued based on the commercial processors’/users’ additional purchases of raw materials at given prices. Conversely, when commercial producers/merchants are selling forward production, they are collectively saying that they feel the silver market is overvalued and that they won’t be able to receive the same prices in the future that they can get at the market’s current prices. Ultimately, it is the ebb and flow of supply and demand as determined by the both sides of the commercial trader category that creates the market swings we like to trade by entering either above or, below value and offsetting the trade at a profit as the market returns to balance.

Putting it all together requires just a bit of homework and a couple of logical assumptions. Both the commercial producers/merchants and the large speculators are near record level positions. The homework goes into the commercial side of the equation. First, we know from experience that the commercial trader total position record was set in June of last year at, roughly 199,500 contracts. The total position indicates the total number of outstanding contracts controlled by the commercial traders. This includes the processors who are buyers and the miners who are producers. This position peaked at just over 201k the first week of July. We combine this with the commercial net position to determine total commercial trader capacity. We do this by examining historical context to see how much the processors purchase when they feel the market is cheap, relative to how much the producers sell when they feel the market is overvalued.

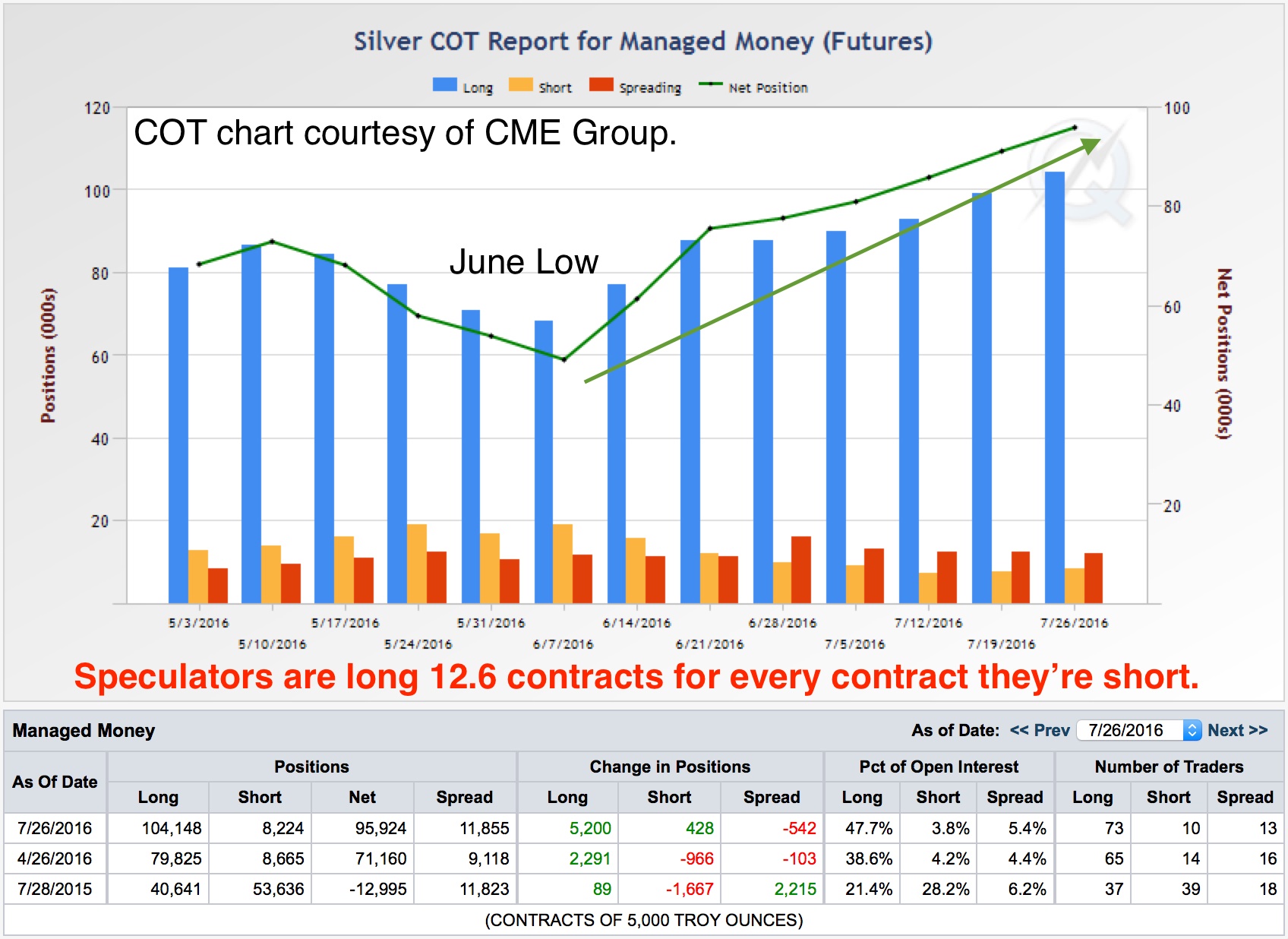

The current commercial net-short position is now more than 107k contracts. This is offset by a large speculator position of more than 96k. However, the internal makeup of the positions within the two groups couldn’t be more disparate. The commercial traders, though short more than 107k contracts maintain a net position to total position ratio near 2, while the speculative long position compared to the speculative total position of less than 1.6. Putting this in a more startling context shows that large speculators currently own 12.6 contracts for every contract they’re short. This compares to a commercial position that is currently short 4 contracts for every 1 they are long.

Andy Waldock, owner of the brokerage firm Commodity & Derivative Advisors and the subscription service COTSignals.com, is a third generation commodity trader with over 25 years of experience on all of the main U.S. exchanges. Andy stays abreast of modern programming developments due to the trading programs he employs for his own account and managed money. He can be reached at www.andywaldock.com.