What is the Power Crossover Method?

Trend following strategies are easy to use when markets are trending. The challenge lies in identifying entries early enough in the trend, and then getting out of the market before the trend has come to an end. The Power Crossover Method was designed to address both of these challenges.

SWING TRADE WITH MOMENTUM

The Power Crossover Method is great for swing trading stocks. The method is easy to use since it relies on a combination of three popular indicators: Stochastic, RSI, and MACD.

Using the Power Crossover Method, the goal is to wait until all three indicators confirm a directional move. This is accomplished by using MACD to determine the direction of the market, then waiting for RSI and Stochastic to cross the 50 value. Using additional indicators to confirm the trend will help filter out some of the whipsaws that might be experienced when relying on MACD alone.

STRATEGY SETTINGS

The Power Crossover Method uses the following three indicators and settings:

Stochastic %D = 14, 3 (standard settings)

RSI = 7 period setting (standard is typically 14)

MACD = 12,26,9 (standard settings)

RULES OF THE TREND

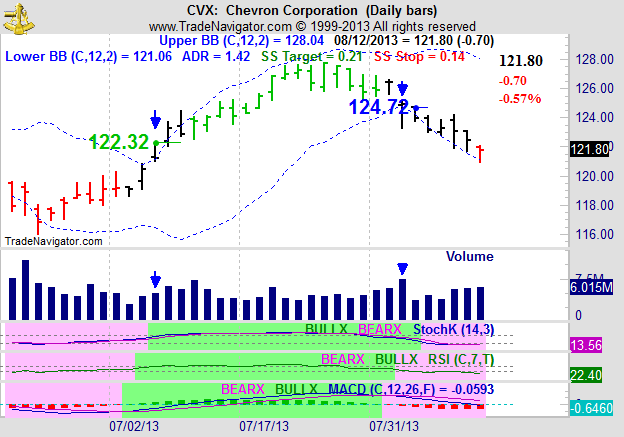

Source: Courtesy of Trade Navigator

In the chart above you will see that custom highlights are used to highlight indicators when uptrend conditions are met. Uptrend conditions are highlighted green, and downtrend conditions are highlighted pink. Uptrend conditions occur when the MACD line is above the Zero Line and also above the Signal Line (a moving average of MACD).

MACD is used to determine the direction of the market, but RSI and Stochastic are also important to confirm the trend. RSI is in an uptrend when the RSI value crosses 50. Stochastic is in an uptrend when the Stochastic reading crosses 50. When these three conditions are met, we have a market that is in an uptrend.

UPTREND RULES:

Stochastic %D (14,3) > 50

RSI (7) > 50

MACD > Zero Line > Signal Line (9 period)

The opposite is true for a downtrend. As previously noted, downtrend conditions are highlighted pink in the chart when conditions are met for a downtrend. This occurs when MACD is below the Zero Line and also below the Signal Line. To have a true signal we also need to make sure that RSI has crossed below the 50 level, and Stochastic is also below the 50 value.

DOWNTREND RULES:

Stochastic D (14, 3) < 50

RSI (7) < 50

MACD < Zero Line < Signal Line (9 period)

HOW TO ENTER AND EXIT WITH THE STRATEGY

This method is great for identifying trends in the market. An entry signal is considered when ALL three indicators are indicating a trend. Trading stocks, a buy stop order is placed 1 cent above the high of the signal day for an uptrend, and a sell stop order is placed 1 cent below the low of the signal day for a downtrend.

Using stop orders to enter the market will help avoid trades after significant market gaps in the opposite direction of the trend. Many times this results in a short-term pause or reversal, indicating trend weakness. For this reason orders should be kept in the market for a maximum of three days. If an order hasn’t been filled at the completion of the third session, the order should be canceled.

Knowing when to exit a trend is just as important, if not more important than knowing when to enter a trend. When one indicator crosses in the opposite direction, this is a warning that the trend might be on the verge of changing direction. Conservative traders might want to exit the trade at this point in time, or consider some trade management to reduce the amount risked on the trade. When two indicators cross in the opposite direction, this is a sign that the trend is weak and an exit should be considered at the opening of the next session.

Source: Courtesy of Trade Navigator

In the daily chart of CVX above, there is a Long signal at the close of the session when all 3 indicators are meeting the criteria for an uptrend. The high of the bar is $122.31 so a Buy Stop order is placed 1 cent higher at $122.32. In this example the market gapped up slightly, so in this example the fill would have likely been at the open of the session at approximately $122.39. The market continues to move higher and when MACD crosses back below the signal line we have our first warning that the trend is weakening. After the next session RSI crosses below the 50 value. With two indicators indicating a downtrend based on the strategy rules, an exit should be considered at the open of the next session. Using a market order to exit, a fill at approximately $124.72 to close the trade for a $2.33 profit.

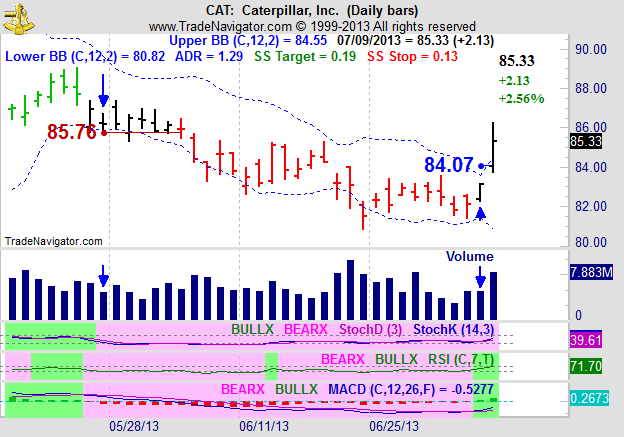

Source: Courtesy of Trade Navigator

In the chart above we have a daily chart of CAT. There is a short signal when all three indicators are bearish based on the strategy rules for a downtrend. The low of the session when the signal occurs is 85.77 so a Sell Stop order is placed at 85.76, 1 cent below the low. During the next trading session the market gaps higher and never trades at the entry price. The next day the market gaps down at the Sell Stop order would have been triggered at the open. Let’s assume a fill at the open at 85.73. The market continues to move lower and eventually RSI crosses back above the 50 value on the first strong retracement higher. This would be a warning, and some traders might consider adjusting stop losses to minimize any risk on the trade. A few sessions later RSI crosses back above 50 and MACD crosses above the Signal Line. With 2 indicators showing the possibility of an uptrend it’s time to close the trade.

ADDITIONAL WAYS TO EXIT THE TRADE

There are times when fixed exits can be used to take profits early. Although bigger moves will be missed when using profit targets, the use of profit targets will free up trading capital. In addition, there are many situations where fixed exits will offer conservative traders a chance to take profits before a trend comes to an end.

A great way to determine exits is to use the Average Daily Range (ADR). The ADR is defined as the 7 day average of the session HIGH – the session LOW. Using the Power Crossover Method for entries, a stop loss can be placed at 2 times the ADR, and a profit target can be set at 4 times the ADR.

For example, the current ADR of BA is $1.22. If a signal is considered the stop loss would be placed at $2.44 (2 x 1.22), and a profit target would be placed at $4.88 (4 x $1.22).

Traders that don’t want to calculate the ADR might consider a 3% stop and a 6% target. Using BA currently trading at $104.22 as an example, the stop would be $3.13 ($104.22 x .03 and the target would be $6.26 ($104.22 x .06). The fixed percentage exits are easy to calculate, but volatility based exits using the ADR typically have an advantage since they adjust to changes in market conditions.

TIPS AND TRICKS

- High volume stocks like the DOW 30 are perfect for this strategy.

- Be careful of “gappy” stocks, or stocks with light volume like small cap stocks and some ETFs.

- Use Caution trading around earnings.

- Consider using options as an alternative to the underlying stock.

[Leave any questions or comments for Hodge below.]

===