Whenever we look at different places where to put our money, real estate has always come to our minds as traditional investors have made lots and lots of money in this market. It’s only in recent times that with a credit freeze, the brick market has suffered an important contraction.

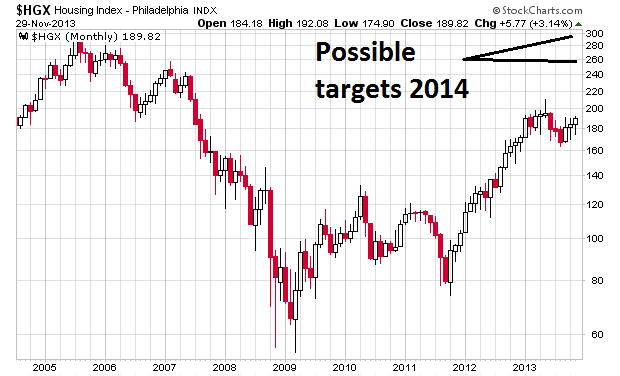

Fortunately, the tide seems to be turning as we see some interesting growth in the chart of the PHLX Housing Sector Index (HGX).

NAHB HOLDS ABOVE 50

The first reason that makes us think this market is ready for us to trade it is that the NAHB have indicated that U.S. homebuilder confidence stabilized in November after falling for two straight months. The index came in at 54 in November and has held above the 50 threshold for the last 6 months.

This is the first encouraging sign.

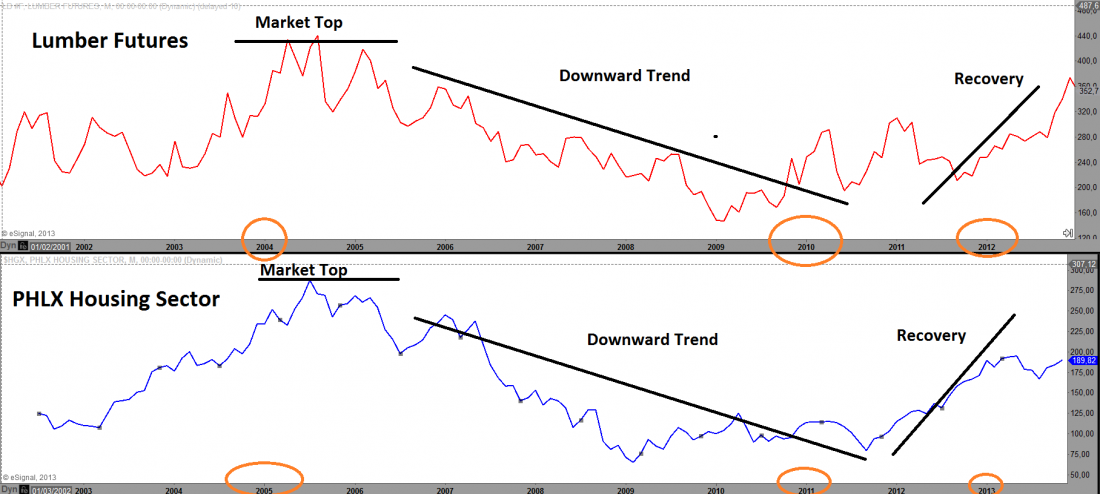

CORRELATION WITH LUMBER

Now that we’re looking for a second reason to trade this market, we find an interesting correlation with the future prices of lumber. This commodity is usually one year ahead of the move we might see in the HGX.

Although the prices of HGX don’t replicate the exact move of lumber futures, there is a clear following pattern with a lag of 11 to 12 months. This means that the price action we see today in lumber futures will most probably be similar to the price action we will see one year from now on the HGX index.

It’s a like a wave at the beach which passes under the end of a pier, and then later hits the shoreline It is still the same wave, but it appears at different times in different places. In this case, it would appear first in the price of lumber and later in the price of HGX.

MARKET DIRECTION

Now that we understand that there is some sort of a link between these two markets, it’s time to look at the direction of the market.

Towards the end of year of 2012, lumber future prices had been trending higher and then surged upward much faster toward a top that came in March 2013. It is the echo of that exact surge in lumber prices which ought to be commencing very soon for housing related stocks, headed towards a top around March / April 2014.

After that, the lumber crystal ball foretells some summer weakness in 2014 for the housing sector, before a recovery towards the end of the year.

CENTRAL BANKS DON’T AGREE

However, the financial stories we hear on the media are contradicting this theory with the ECB stating that the economy is going to remain weak and the Fed is still too worried to start tapering. All that should mean a weak economy and, therefore, a weak housing sector.

Nevertheless, the lumber futures portray a more positive picture for the housing market.

BOTTOM LINE

This correlation is not perfect and has some deviations in price action giving us to understand that lumber’s price movements are not the actual cause for similar moves a year later in housing stocks. But instead, there might be other causative factors affecting both markets, and its effects just show up first in the lumber market and a year later in the housing market.

So, look for a possible spike in the HGX around the end of the first quarter of next year and let’s see if this correlation can continue proving to be right once again.

===

Click here to see how Daryanani uses the RSI indicator on his charts

RELATED READING

Read another story by this author: